I haven’t bought anything with cash in Sweden in well over a year. I’ve barely even touched cash since I got the kids bank accounts so I could pay their allowances from my phone. I’ve been holding the same lonely 20kr bill in wallet for month and months, which is sort of a shame because it’s really pretty and it has a picture of Pippi Longstocking on it, I kid you not.

In my wallet, alone forever. Astrid Lindgren on money is pretty awesome, tho.

There isn’t even any dusty change in between the cushions of my couch. Checks? My landlord moved to the US so I sent her the rent using my US bank’s “electronic bill pay”, which prints a check, stuffs it in an envelopes and friggin’ mails it to someone who then has to sign it with a pen and either go to a bank or an ATM machine to deposit it or use an app that takes a picture of a piece of paper so it can read the numbers. You then wait a few days. The first time she received one of these she wasn’t actually sure what it was and assumed that it was a receipt showing that the money was in her bank account already, because of course. (Sorry, Ninna, I really feel your pain on this now)

It took some time to get used to a money, commerce, and banking system that really has no physical artifacts whatsoever. I expected that it would be buggy and/or convoluted and I was (am still am, to a degree) suspicious of the inherent trackability of all money. But, in practice, everything works surprisingly well; it’s trivially simple to pay for stuff, pay people, and pay bills, and there’s a unified security apparatus that provides two-factor login to banking, as well as to lots of governmental and medical services. It’s easy and instant and it doesn't cost money to move money digitally, and I never, ever, ever find myself missing either cash or US banking in any way.

How it works: Sending money to a person

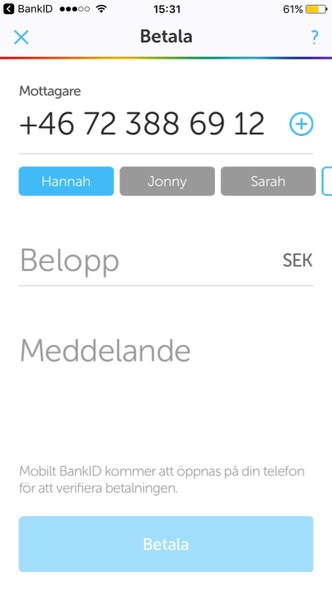

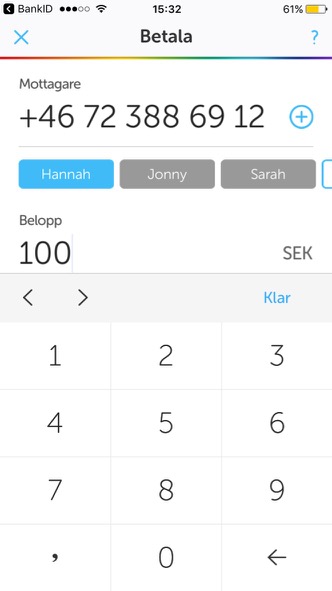

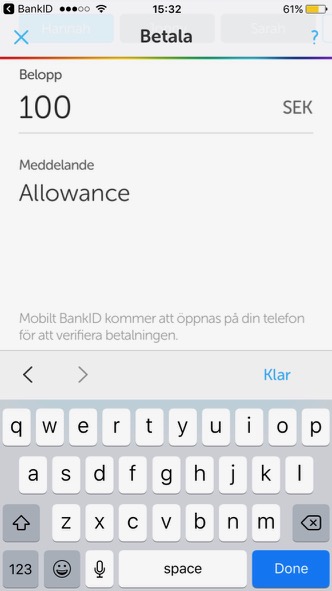

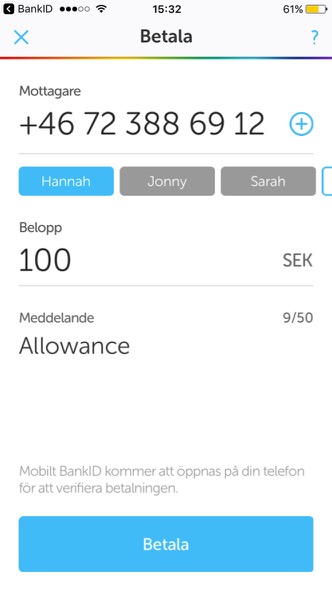

You can send money to most anyone with a mobile phone and a Swedish bank account using an app called Swish. All you need to know is their mobile number.

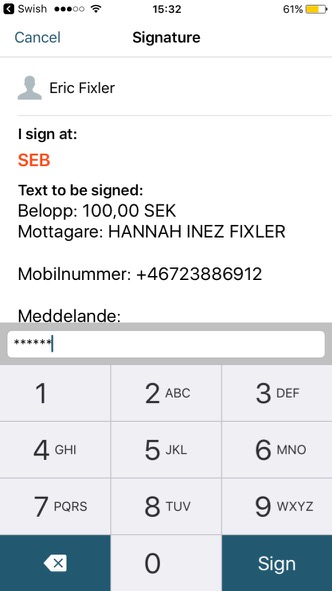

This takes 15 or 20 seconds. Click on the picture of my homescreen to walk through the process, which starts with Swish and also uses BankID, a sort of universal identity and authentication app here that I'll discuss a bit more below. (NB: The captions are hard to read but that's what Squarespace lets me do easily)

The recipient gets a notification and the money is in the bank immediately. The Swish app also has a ledger that shows you all of the money that you've sent and received with Swish, and you can see this info using your bank's app or website as well.

In this example, I'm sending money to my daughter, who is 11. My bank here makes it easy to set up a kids account that's linked to my account, but is real in every way -- the kids get debit cards, Swish, BankID, and access to the bank's mobile app. They're learning how to manage their money, they're proud of that, and it's way easier for me. I don't worry about them losing cash, and I can always shoot them some money in a pinch no matter where I am.

Swish directly replaces cash. You use it to split bills at restaurants, buy snacks at a bake sale, or when you're buying or selling stuff on Blocket (Swedish Craigslist), which I'm doing a bit of right now. It costs nothing, works with all banks, and it doesn't spam you.

Card readers (chip + PIN) are ubiquitous at all stores, but it's not uncommon for shops, especially cafés, to take Swish too. At the Workaround co-working space where I'm writing this, the freestanding coffee and food stand takes Swish, as does the lobby cafe.

NB: It's pronounced "Svish" and the phrase "I'll Svish you" is used in lieu of something more prosaic like "I'll send you money", and always reminds me of the first track of the last decent Rolling Stones record.

Finally, if you noticed the word on the bottom of the price list in the photo, it's one of at least 3 Swedish words for 'sandwich' and if you've been wondering where smorgasbord comes from, now you know, and Big Steve can explain the bord part.

How it works: Paying Bills

Every company or organization has a Bankgiro number, which (like your phone number for Swish) acts as a deposit-only proxy to their bank account. Bankgiro, like Swish and BankID, is a cooperative venture of all Swedish banks, along with some other banks that operate in Sweden.

When you enter a Bankgiro number into your bank's payments and transfers thing, it shows you the name of the vendor; you don't need to know the address, phone number, or anything else, like you do in the US, and payments happen by the next business day, electronically.

A bill usually has what's called an OCR number; this term is a carryover from the age of checks. The OCR number is an identifier for the invoice. You enter your OCR number along with your payment, or, if you don't have an OCR number, you can send a small message along with your payment, again like Swish.

You can also send and receive payments to individuals in this manner, using IBAN account numbers, which are a normal feature of personal bank accounts here. There is no charge for transferring money or paying bills.

Some of my bills come in the mail. Some arrive via a service called Kivra which, essentially, sends you PDF versions of bills and other communications. Kivra is used by mobile and internet providers, and also by the tax agency, credit agencies and so on.

How it works: Authentication

So I need to make a doctor's appointment for me, or for one the kids. I go to 1177.se on the web, click Logga In, enter my Swedish personnummer (akin to a US Social Security number) and submit. Then I launch the BankID app on my phone, which tells me that 1177 is requesting that I identify myself as Eric Fixler. I give the app my fingerprint or enter my BankID PIN code.

I'm now logged into the medical system and I can make appointments, check messages there or whatever. To be clear, I never created a password with 1177, and, in this case, my account exists because I have a personnummer and 1177 knows that that personnummer is real and a part of the health insurance system without any explicit action from me.

The login process, using the personnummer and the BankID PIN, is identical for most things that are in some way related to government or finance services, including my bank, the tax agency, insurance, Kivra, whatever. If you're using an app, like Swish, that lives on the same device as your BankID, the app will launch BankID for you, so there's one extra step when you're using the web.

It's also used for phone, and sometimes even in-person, interactions with banks and such. When I have to deal with my US bank on the phone (a frustratingly common experience for me while overseas, since overseas activity seems prone to triggering account lockouts) they "authenticate" me using a combination of easy-to-acquire information (last 4 of social, mother's maiden name), obscure "security" questions that I answered years ago and may or may not be answer today (who was your favorite teacher? God help me), and things I'm reasonably likely to know if I've stolen someone else's account, but that I can never remember myself (what was the amount and date of your last withdrawal?).

In Sweden, you call your bank, tell them your personnummer and they trigger a BankID authentication event. PIN or fingerprint, and you're verified. Online, you're not dealing with a menagerie of user ids, passwords, and account creation processes, all with different content requirements, verification processes, contact info, etc.

As far as I know, this is the broadest application of a 2FA (2 factor authentication) system in the wild. With 2FA you use something you have (your phone), in conjunction with something you know (your PIN, although I suppose your finger is also something you have) to verify who you are. The chance of having your security compromised is reduced, because while someone else might find out something you know, or take something you have, it's less likely that both will happen at the same time.

It's a slight hassle if you lose your phone or your phone breaks, because your BankID installation is tied to your individual phone. Overall, it is so much easier to deal with than the gaggle of logins, passwords and verification channels that we typically use in the US.

Why it all works

By now you hopefully understand a bit about how the payment infrastructure works in Sweden, and how banks and tax, medical, and other entities connect to and authenticate an individual's data using the personnummer as the identifier and with BankID for authentication.

But why here? Sweden isn't the only place on earth where people think cash is obsolete.

I suspect that there's some contingent in the US who are suspicious of the whole idea of taking money digital, either because explicit tracking lends itself to a high degree of data collection about an individual's activities, or because it facilitates tax collection, or both.

The ubiquitous use of personnummer was a little spooky to me when I got here, and it's a little jarring when you log into a service you've never used before and it knows your home address. At the same time, bad tech isn't a replacement for bad law. Sweden's online privacy laws aren't perfect, but they protect an individual's privacy interests and require consent to a greater degree than their US analogs. It is not legal here, for example for ISPs to monitor your online activity for marketing purposes without your consent, as they can in the USA.

In the US, corporations (and the government) run massive operations to collect data about you for profit, without your consent, and they infer your identity from disparate sources, often incorrectly. At least in Sweden, when a credit check is run on me I have to consent to it and I'm pretty confident that the information is correct because it's coming from my true identity.

One of the goals of digitizing the movement of money is specifically to ensure that everything is reported for tax purposes. Sweden extends significant, and sometimes surprising, efforts to ensure the accuracy of tax reporting.

The government pays for half of all home improvement costs, including housecleaning. You did read that correctly. This was done in part for economic stimulus, and in part to keep money that's typically 'black' in the system instead. And when I say pays for, I mean pays for, not 'you save a receipt and hire a guy to do your taxes and then if you really qualify you get a discount on your taxes a year later'. When you pay your contractor, or your housecleaner, you only pay them half the money. They collect the rest directly from the government, reasonably easily and enabled in part by same digital payments ecosystem that enables Swish. And homes are really nice on the outside, and really clean on the inside.

Lots of people here would like to pay lower taxes, but taxes just aren't a manichean freakshow like they are in the US. Fairness is a really important value in Sweden, so people tend to be sympathetic to systems that help ensure that everyone is paying their fair share. Swedes have high expectations of government, they're used to direct payments for benefits, and filing taxes here literally takes 30 seconds because all the information is already compiled, so maybe the benefits just outweigh the disadvantages.

I was initially surprised that Swish was free. When I first heard about Swish, I assumed that there was some startup that had managed to put together a decent peer-to-peer payment system, and that it's coverage was probably limited to some subset of millennials and that their business plan was somehow based on taking a small vig off my payments, or that there was some other catch. It also never crossed my mind that a consumer application could be the product of a partnership of big banks. This doesn't happen in the US.

In hindsight, it is remarkably obvious that using cash is free and not institutionally bounded, so if you want to replace cash, you need to replace it with something seamless and free.

Making money transfer easy and free implies long-view thinking. It requires deep legislative, bureaucratic, and corporate collaboration. It suggests that the banks are less interested in squeezing every cent out of transactional friction than they are in aligning themselves for the next wave of evolution in finance and technology. The big goal here seems to be in building value-adding services on top of a digital money ecosystem, both in Sweden and beyond.

Swedes are proud of their ability to marshal national will to solve a problem or achieve a big goal. They used to drive on the left side on the road, and then they decided it'd be better to drive on the right. This is a very non-simple thing, since it requires all kinds of changes, from signage, to headlights, to road stripes, and also meant that everyone had to stay off the road for a day. I've heard the tale of Dagen H many times over the past 18 months. (It's a great story, I know it well now, tack tack :) They are in the middle of moving an entire city 3 kilometers. They like to have a project. I can relate.

In contrast, you have go back to JFK and LBJ to find programs like the Apollo missions and the Great Society that contain a vision of what the future looks like and articulate what the USA should like in that future. More recent presidents and politicians have primarily focused their vision on what government and taxes should look like, or, more recently, on a nihilistic abnegation of whatever goals their perceived enemies have. You can find some basis for comparison between initiatives like Obamacare and the Paris Climate Accords and Sweden's deprecation of cash. Such a comparison is beyond the scope of this post, but it seems reasonable to say that the US struggles to coalesce deep and mobilized consensus behind ambitious initiatives with big goals. This may be the biggest single problem in the United States right now.

Cash is rapidly receding as a payment method in Sweden. Many shops, particularly cafés and restaurants, don't even take it. For me, and for most people here, this is a tremendous convenience. For older people, maybe not so much. One of the small joys of Stockholm is seeing hearty old folks, out and about, riding their bikes, doing their thing. From time to time I'll spy someone who can't partake in a fika because they don't have a card.

All that said, this is really happening, or, really, it has already happened. There are certainly some possible non-utopian outcomes of a cashless society, but as I've been re-entering the US banking system over the past few weeks in preparation for the big move back, I can categorically state that banking in the US is an incredible hassle compared to banking in Sweden in many ways, some documented here, and some not.